The UK Financial Service Sector Post Brexit

Introduction

Brexit is basically the shorthand way of expressing that UK has left the

European Union. It is the fusion of the words Britain and exit – Brexit. It happened through a

referendum basically a vote in which everybody old enough to express their

choice was conducted on the 23th of June 2016 to decide whether UK should still

be a part of the European Union or not. 51.9% (as opposed to 48.1%) of the votes

supported that UK should leave (BBC.Com, 2019). The participation of the

voters was 71.8% and almost 30 million people had cast their opinion.

Impact of

Brexit on the UK Financial Services Sector

The immediate aftermath of the Brexit had a direct effect on the

financial sector. There was a plunge in the stock market. The sterling got a

blow. The confidence of the consumers or the investors received a big jolt.

Since then, the financial sector has been in the limelight for several reasons:

The financial sector of the UK happens to be one of the most influential

sector of the British economy (UK.Reuters.Com, 2019). Its

contribution to the total GDP of UK is almost 12%. That apart, it is also

responsible for the employment of more than 2 million people. Also, UK happens

to be the largest export entity and it constitutes almost half of the services

trading. The banks of Britain lend almost USD 1.4 trillion to the European

Union government and companies(Ig.com, 2019). Also, numerous financial transactions

that happen in Europe areeither directly or indirectly initiated or controlled

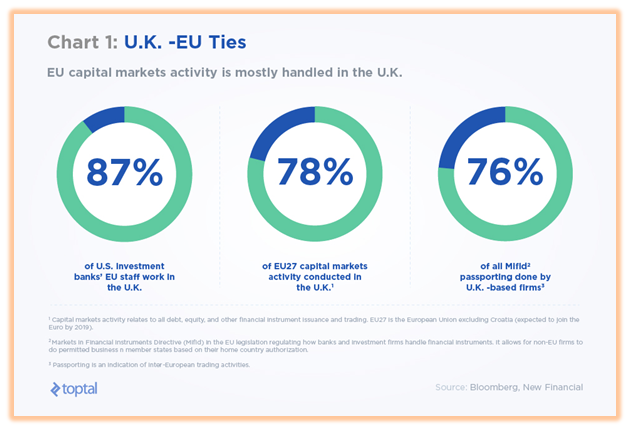

from London. In fact, more than 85% of the people employed with the US

investment banks in EU are employed by London(The SWIFT Institute,

2019).

Source:

(UK.Reuters.Com,

2019)

Now, the question is to what extent Brexit actually effected the

financial sector. An analysis of few issues and concerns of the financial

domain reveal the following worrying facts:

Pass porting

Pass porting is the process by which a British financial company (bank,

insurance, asset management institute, etc.) extends it services, whether

services or products, to EU (Grantthornton.co.uk, 2019). This is

done without any license or any sort of regulatory obligations or any local

setup or anything. Reports indicate that close to 5500 institutes in the UK

carry out business activities with EU through pass porting. And, the process is

a both way traffic. EU too trades with UK through the same mechanism. With

Brexit, it is obvious that the system of pass porting will no longer be

applicable(Grantthornton.co.uk, 2019).

Regulatory

Uncertainty

The second crucial concern of Brexit is the regulatory uncertainly. The

regulations have been the strength of Britain, the reason why London became the

financial capital of Europe(Grantthornton.co.uk, 2019). This

happened because of two reasons –The English laws with advantages like

insolvency regulations and debt issuance rules and the relaxed and employer

friendly British labor laws(Grantthornton.co.uk, 2019). However,

with Brexit things have simply become complicated. First, Britain will have to reviseEU

rules and trade practices that have been followed since over 40 years. This

will not just be time taking but many firms may not be able to hold for that

long. If this talent pool undergoes any change due to visa complications or job

loss probability, it’s obvious that these talents will go elsewhere(Grantthornton.co.uk,

2019).

Brain Drain

The third important impact of Brexit – Brain drain. This was the factor

for London’s rise. London has got world class and field specific talents(Grantthornton.co.uk,

2019).

Short term

prospects appear weak

Investment banks have started shifting their back office operations

elsewhere already and that is a huge effect.

Source:

(Grantthornton.co.uk,

2019)

There is no doubt that there are more consequences of the Brexit that

are still in store. The train has left and there cannot be any turning back

now. The fact is that something has crumbled that was otherwise pretty

efficient since more than three decades (Taylor, 2019). It seems

obvious that there will be prolonged period of business uncertainty post Brexit

in Europe. There is still uncertainty how things will play out over the coming

years, something which is not on the brighter side.

Reference:

Brexit Britain's

financial sector faces 'slow puncture'. UK.Reuters.Com (2019).

Retrieved from https://uk.reuters.com/article/uk-britain-eu-city-insight/brexit-britains-financial-sector-faces-slow-puncture-idUKKBN1OA1SN

Brexit: All you need

to know. BBC.Com (2019). Retrieved from https://www.bbc.com/news/uk-politics-32810887

Grantthornton.co.uk(2019).

Retrieved from

https://www.grantthornton.co.uk/globalassets/1.-member-firms/united-kingdom/pdf/brexit-impact-financial-services.pdf

How will Brexit

impact UK financial services?Ig.com (2019). Retrieved from

https://www.ig.com/uk/news-and-trade-ideas/other-news/how-will-brexit-impact-uk-banks-and-financial-services---181114

Taylor, C. (2019).

UK financial services industry moves $1 trillion in assets to Europe due to

Brexit, survey says. Retrieved from

https://www.cnbc.com/2019/01/07/brexit-uk-financial-services-sector-moves-1-trillion-in-assets-to-eu.html

The Impact of Brexit

on the Financial Services Industry | the SWIFT Institute. (2019). Retrieved

from https://swiftinstitute.org/newsletters/the-impact-of-brexit-on-the-financial-services-industry/

Comments

Post a Comment